Don't Be the Typical Behavioral Investor on the Market Rollercoaster

The market can remain irrational longer than you can remain solvent.

John Maynard Keynes, one of the most important economists of the 20th century.

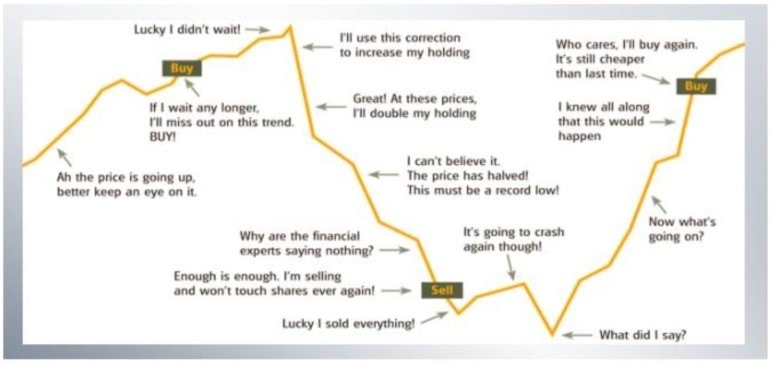

The following picture shows why most people lose in the market. They buy too high and sell too low – just because they trust their feelings – but feelings don’t work the way the market works.

The researchers Hens & Caliskan showed the typical behavioral investor on the market roller coaster where many private investors end up being a procyclical loser.

So there is not a chance to get the right market timing, not as a private investor, and probably also not as a professional. If you want to time the market, the only option is to buy when it is low, sell when it is high.

This might also mean that you will have to take some losses because you buy when the market is falling and you will sell high, and see profits that you could not realize while sitting on a pile of cash and you cannot invest it anywhere but put it on a bank – who knows for how many years.

If you cannot bear that, a continuous investment over time will help you to build up wealth as the times of market downturns are much shorter than the upward movements.

Stay Calm When Investing

It’s not what a man doesn’t know that makes him a fool, but what he does know that ain’ t so

Josh Billings, 19th-century American humorist

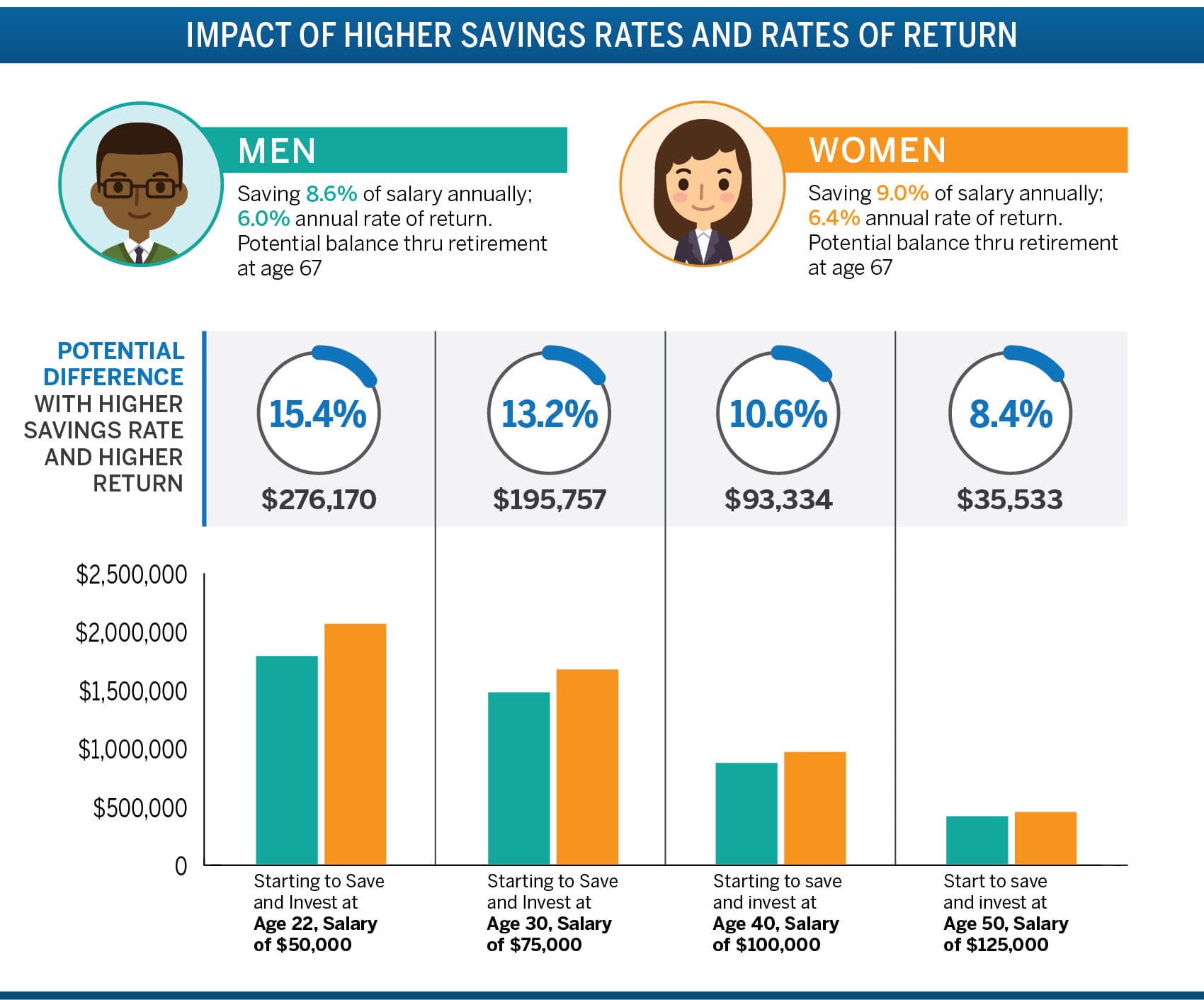

Several studies have shown that women are better investors than men. A recent study by Fidelity Investments shows the following:

- Women plan better and have a better overview: they build financial plans and define their life goals taking into account their family and not only performance.

- Women prefer long-term strategies: Women take conservative views on their investments and look at the long term, tending to use buy and hold strategies.

- Women take less risk: Women diversify well and invest less in risky assets than men do.

- Women are patient: Men are 35 percent more likely to make trades than women, also men trade 55% more than women who trade.

This has not been a recent effect, earlier studies showed the same results (see the study of Brad Barber and Terrance Odean and the ING-Diba study).

The Learnings: Invest Calmly, Have a Strategy and Diversify

Essential is that you reduce your costs as much as possible to keep the profits that you are making.

Also, choose simple instruments that you understand and which can be handled with little time effort. We don’t want to give you an additional job, we want a long-term increase in your wealth based on your savings. Diversification is the key. When you are young it is also ok to take some risk in a portion of your investment.

We call this the Investment Canvas and not the Gambling Canvas. Always look at what you buy, the people who work with it every day know more than you, so stick to reliable instruments! Also, do not leverage your investments – this will bring you into the danger of losing everything - this is gambling.

Of all the companies on the New York Stock Exchange in 1911 only one company survived: General Electric. All other companies developed in a manner that they fell out of the index, went into bankruptcy or were bought. If you do not have the experience to follow up regularly on the market development and actively trade, you can easily just follow the index.

Thereby, you will always have successful companies in your portfolio and the probability that value will be created is extremely high.

However, if you are willing to take some risk you can invest a small share in high-risk investments. Mark Cuban says that it is ok so invest up to 10% in high-risk investments, but you must be prepared to lose it all!

After all: Do not overvalue information – stay calm, look at the bigger picture! Probably you will end up in allocation of following investments:

- Bonds or Bond ETFs

- Equity ETFs

- For anybody willing to take risk, allocate a small part into risky investments like Passion Investments or Modern Investments.