The Investment Strategy

Learn how to build a long term investment strategy based on your personal requirements.

- Set your goals and define your asset base

- Define your investment philosophy and preferences

- Set your strategic asset allocation

Learn how to build a long term investment strategy based on your personal requirements.

Strategy is the art of making use of time and space. I am less concerned about the latter than the former. Space we can recover, lost time never.Napoléon Bonaparte, Emperor of the French, won most of his wars, built a large empire that ruled over continental Europe, dominated global affairs.

The investment strategy chapter will help you determine your goals, if they are realistic and how your basic strategy will look like – based on the knowledge that you have and risk that you are willing to take.

Do you want to be right, or do you want to make money

Investment saying

Many people want to prove themselves in the market that they were right. They look for active decisions and active management of single investments to tell great stories about their profit. These people never consider investments where they were wrong. This way, they usually end up losing money.

Get rid of this thinking! Think differently when you want to successfully manage your money. Humans are not oracles but we can stick to indicators and general market rules. Therefore, it is much more important to diversify and mitigate risk than to be right.

Always leave a way out, unless you really want to find out how hard a man can fight when he’s nothing to lose.

Robert Jordan, author of "Wheel of Time"

The investment strategy is the basis that your investment is built-upon. It is necessary for you to know what you are doing, why you are doing it and which rules you have to follow. It helps you to save your money and increase your wealth. It lets you keep calm in difficult moments, e.g. during a crisis.

An investment strategy consists of an investment goal, the risk affinity and leads to the selection of an investment portfolio. It highly depends on the skills the respective investor has and the time and money he wants to invest.

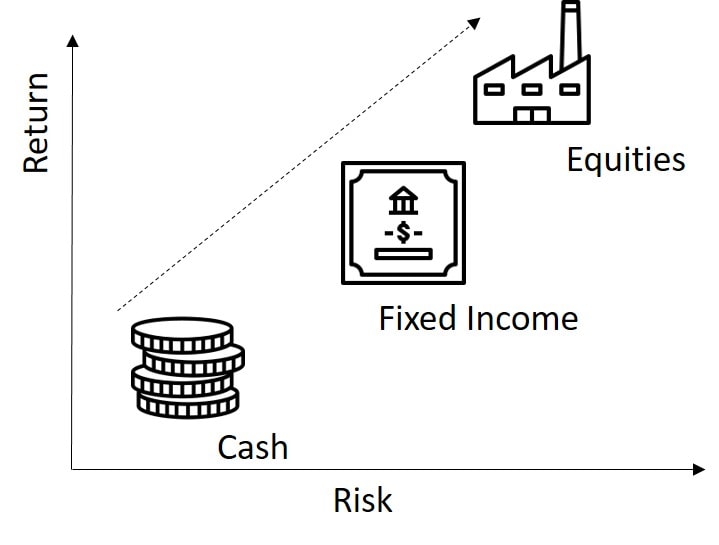

Usually, the investment strategy must always regard a tradeoff between risk and return. Most investors are willing to accept some risk for the expectation of higher returns, but investors differ widely. However, there are two basic rules that every investor should follow:

In general, this can be seen in the following graph, where cash has the lowest risk but also the lowest returns, fixed incomes like bonds have a little higher risk and some more return and equities, e.g. stocks have the highest risk and highest possible return.

We will go into more detail in the following, this is just a very general example.

An investment strategy takes into account that markets go up and down. It will let you stay calm when your investments go down, you will consider the investments going down as a part of your strategy. This will enable you to stay cool and make the right decisions! For a profound investment strategy, you must define your personal goals, the willingness to take risks and define your portfolio.