Start Your Investment Canvas

The secret of getting ahead is getting started.

Mark Twain, American entrepreneur and author of “The Adventures of Tom Sawyer” (1876) and its sequel, the “Adventures of Huckleberry Finn” (1885), the latter often called "The Great American Novel"

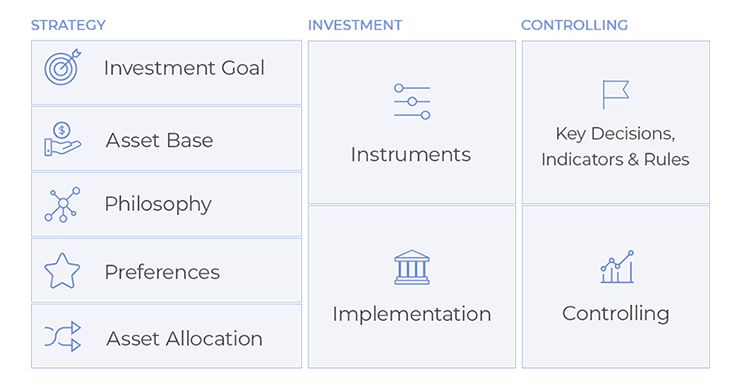

If you have not done so far, start creating your Investment Strategy now! Then start investing and keep on controlling as mentioned above. The Investment Canvas is the ultimate tool to support you. It is independent and free of charge. Just by saving the costs that your financial advisor will bill you, you are already better off than with the professional advisor. Because if he was so good, he would probably not have to work anymore for a fixed fee!

Define Key Decisions, Indicators and Rules

The imperative is to define what is right and do it.

Barbara Jordan, first African American elected to the Texas Senate after Reconstruction, elected to the United States House of Representatives.

In general, your investment strategy should look at the long term. Therefore, all the indicators and rules that you choose should be looking from this perspective. However, if you are very afraid of losing money, you can also define automated selling rules for your investments so that you can have a good night's sleep and do not have to worry about checking your investments on a daily basis.

Control Your Investments

Personal finance…is more personal than it is finance.

Tim Maurer, author of "Simple Money: A No-Nonsense Guide to Personal Finance.

Even though you do not have to get involved in active trading, you should at least monthly check your portfolio and align according to the Rules that you have set. Stay calm in rough market times, look back on history and be sure the markets have come back always until now!

Revise Your Canvas Regularly

Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.

Jason Zweig, an American journalist, publishing in The Wall Street Journal, author of 4th edition of “The Intelligent Investor” by Benjamin Graham and “Your Money and Your Brain”

Your personal preferences and goals change in the course of time! Therefore, revise at least annually your Investment Canvas. You can update it accordingly by putting the value of your current portfolio as an initial investment in the Asset Base.

Summary

Controlling all comes back to having a clear mind and not being emotional. Pre-defined key decisions, indicators and rules will help you to stay clear in your head! Follow the roadmap below to regularly revise your investment strategy.