Understand the Different Asset Classes

Look deep into nature, and then you will understand everything better.

Albert Einstein, German-born physicist, invented the formula that has been dubbed "the world's most famous equation": E = m*c^2, received Nobel Prize in Physics in 1921

There is not a single right categorization of asset classes, e.g. futures can be seen as its own asset class or as part of the same asset class as the underlying instrument with different regulations than the underlying instrument. The Investment Canvas is trying to

- Give you an overview of all possible investments and

- Keep it simple.

What looks so complicated is quite simple in the end! We differentiate 7 asset classes and this already includes non-traditional (alternative) investments! When you have understood the concept of asset classes, you will be able to create your personal investment strategy.

All investments that are out there in the market, can be categorized into one of the asset classes. It is crucial for the next articles and the completion of the Investment Canvas to understand the different asset classes. Therefore, please read thoroughly. The following table gives you an overview of the different asset classes.

Overview of Asset Classes

Cash & Cash Equivalents

Cash & Cash equivalents comprise currency or currency equivalents that can be accessed immediately or short-term, usually within 90 days (3 months) or less . Cash equivalents must be highly liquid and therefore able to be quickly sold on the market. Cash investments usually are seen as a lower risk, lower return option than other asset classes. Cash & Cash equivalents are useful for very risk‑averse investors or as temporary storage in between longer‑term decisions. They are less suitable for investors seeking long-term capital growth as they have low interest rates.

Bonds

Bonds are issued by companies and governments as a way of raising money, you can think of them as a loan you give and for which you receive a certain interest rate. Bonds provide a regular stream of income through the interest rate over a defined period. They are promised to return investors their capital on a set date in the future. They are perceived to be lower risk than equities but also typically deliver lower returns over the long-term. The quality of the bond determines the interest rate. Therefore each bond has a rating, that it receives by different rating agencies. The higher the rating, the more reliable the bond, but also the lower the return.

Equities

Equities or shares are issued by public limited companies. They are traded on the stock market. Investing in equity, you buy a share in a company. Thereby, you become a shareholder. Equities can make you money in two ways:

- The value of the company can go up as stock prices rise,

- Annually profits are paid to shareholders in the form of dividends.

Neither of these value growth opportunities is guaranteed and there is always the risk that the share price will fall below the level at which you invested. The risk can be reduced through diversification e.g. in funds or ETFs.

Real Estate

Real estate itself is property consisting of land and the buildings on it. Investing in real estate describes buying, owning, managing, renting and selling real estate. Due to its nature, a real estate is an asset form with limited liquidity compared to other investments. Furthermore, it is capital intensive. The advantage is that capital may be gained through mortgage leverage, this means you can make an investment that is much higher than the money you put in and giving the real estate as security for the loan. However, this must be managed well, otherwise, it is a risky investment.

Commodities

Commodities are distinguished into: 1. Hard commodities: natural resources that must be mined or extracted (gold, oil, etc.), 2. soft commodities: agricultural products or livestock (wheat, coffee, sugar, soy, beef, etc.). Commodities are known to be very volatile and risky. They can achieve big gains as well as big losses. This volatility can be in the investor's favor in a diversified investment portfolio. A small number of commodities can balance risks associated with stocks, bonds and cash.

Modern Investments (Alternative Investments)

Modern Investments are any kind of investment that is not yet institutionalized by banks or other investors and are especially driven through emerging technologies on the internet. As modern investments do not have a history, predictions are difficult. Gains can be exponentially high but complete losses are also usual.

Passion Investments (Alternative Investments)

Passion investments are investments into goods that have an emotional value to collectors of the items. The gains can be very high but also risks associated are high as a judgment on neutral criteria on an emotional market is not possible. Passion investments are always related to special knowledge in the investment.

Understand the Risk and Return of Different Asset Classes

Risk never looks like a risk when it’s generating a high return.

Howard Marks, American investor and writer, co-founded Oaktree Capital Management

As explained in the Investment Preferences article, risk and return are closely related, the higher the risk the higher the possible return. Depending on your risk portfolio you should have different shares of your investment in the different asset classes. The following table gives an overview of the different asset classes, their main risks and the risk/return ratio.

Especially retirement plans that are supported by the government or your employer offer a much better ration of risk and return. E.g. if your employer chips in the same amount you do, that’s a 100% return, no market can beat that. However, these plans are limited in the amount of money that you can put in, so for sure you will also need other assets. However, they build a strong foundation for your retirement planning.

Risks of Asset Classes| Asset Class | Main Risks | Risk / return |

|---|

| Cash & Cash Equivalents | Counterparty Risk, (Currency Risk, Inflation Risk, Interest Rate Risk) | very low / very low |

|---|

| Bonds | Counterparty Risk, Interest Rate Risk, Liquidity Risk, (Currency Risk, Inflation Risk) | low / low for bonds with good ratings |

|---|

| Equities | Market risk | Medium-high / medium-high (medium for large caps, high for small caps) |

|---|

| Real Estate | Cashflow Dependency, unsuccessful Management, Liquidity Risk, (Currency Risk), sunk costs (commission, taxes, …) | Risk / Return: undefined (depending on case) |

|---|

| Commodities | highly volatile market, deep knowledge necessary | high / high |

|---|

| Modern Investments | no historical judgment possible | very high / very high |

|---|

| Passion Investments | Illiquidity | low-high / low-high |

|---|

Define Your Strategic Asset Allocation

Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep by him in reserve.

Phrase from the Talmud, the central text of Judaism, Jewish religious law and Jewish theology

Everyone has an asset allocation anyways! If your money is in the bank account, your asset allocation is 100% in cash. This means 100% in low-risk investments. So as you have an asset allocation anyway, why not do it strategically?

In the previous chapter you already learned what a risk profile is. The previous table associated the returns and risks to the asset classes, you can use this to have a look where you should invest in:

- Cash & Cash Equivalents: This is the safe harbor, but small returns

- Bonds: Also quiet safe with better returns than cash, a good investment for the low-risk share of your investment

- Equities: The basic for medium-risk investments (large caps), to be found in most portfolios. If you want to take some more risks go with a certain share for small caps or foreign companies.

- Real Estate: When you are willing to spend some extra time, you can allocate money into real estate. But it is a business, where you have to know what you are doing!

- Commodities: This is a high-risk investment, only for professionals!

- Passion Investments (Alternative Investments): If you have a specific talent in arts, historic cars, jewelry or whatsoever and the according initial amount of money to invest in, you can make good returns. However, this does not account for the regular investor without specific knowledge, he should stay away from passion investments.

- Modern Investments (Alternative Investments): This is a very high-risk investment, only go here when you are okay with losing all your money!

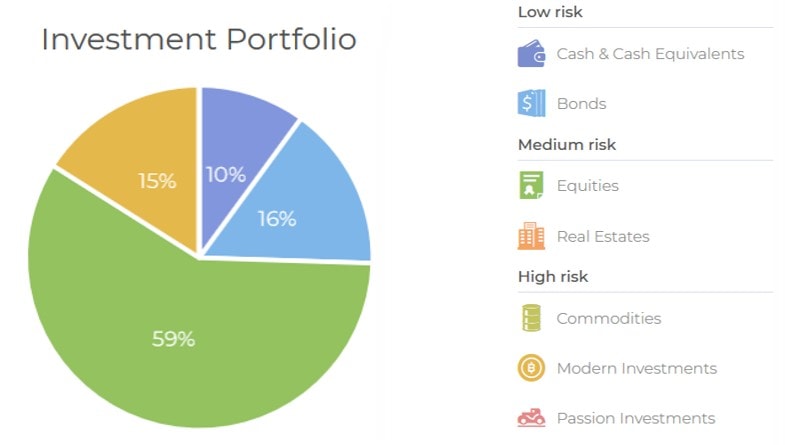

An example of a Strategic Asset Allocation from the Investment Canvas can be seen below. For your personal Strategic Asset Allocation, complete the Investment Canvas!

Estimate Average Return and Risk

The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that is likely to get you where you want to go.

Benjamin Graham, investor and author of “The Intelligent Investor”, grandmaster of Warren Buffet

So now we know a lot about risk and chances for returns. But what does that mean in numbers? We also diversified the portfolio in different asset classes and chose a distribution that fits our risk aversion. So, can we have an estimation of how the portfolio will develop?

To get there, we stick to the known classification of returns and risk and we put them in numbers. Therefore we use the

- average expected return and the

- average volatility (risk)

The average expected return is the return an investor anticipates for a certain investment. To calculate it we take into consideration historical data, still, the return is not guaranteed, it is the best possible assumption we can make.

The volatility shows how the returns on an asset fluctuate. If you put your money in your home currency at a fixed interest rate of 1% onto your bank account, your expected return is 1% and your volatility is 0%.

However, interest rates are usually not fixed, so even if you put money in your bank account there is volatility. The volatility increases if you buy equity, the expected return as well. In a good year, you maybe make 15% in the market, in a bad year you lose 15%. As you can see the volatility is much higher.

In mathematical terms, the volatility as a measure for risk is calculated by using the standard deviation or variance of the asset that you look at. Therefore you always consider historical market data. This is why assumptions vary, depending on which data (number of years you look at, country etc.) you look at. The higher the volatility, the higher the risk of an asset.

There is a lot of number crunching involved in calculating these numbers. Luckily enough, there are experts out in the world who do that for us. Trustable Sources for finding out the average expected return and the average volatility for different asset classes are:

- Black Rock, the legendary investment group, publishes an overview of current return on volatility. The overview is very nicely presented in an interactive chart.

- J.P. Morgan's Long-Term Capital Market Assumptions summarize their risk and return expectations over a 10- to 15-year horizon. More than 50 asset and strategy classes are included, for more profound insight.

- Research Affiliates have a very good overview of return and volatility based on an analysis of the past years. It is also presented in a very appealing chart.

If you want to know more detailed, how Black Rock calculated these numbers, please read here. Below you can find an overview in a table, which we use as a basis in the investment canvas to calculate possible outcomes of your investment strategy.

You are free to change these assumptions in your personal Investment Canvas.

Risk and return of asset classes| Asset Class | Average expected return | Risk (Volatility p.a.)* | Comment / Source |

|---|

| Cash & Cash Equivalents | 1,9% | 0% | Black Rock 2018 |

| Equities | 1,8% | 4,4% | Black Rock 2018 |

| Bonds | 1,9% | 0% | Black Rock 2018 |

| Real Estate | 4,9% | 15% | Black Rock 2018 |

| Commodities | 2,9% | 15,2% | Black Rock 2018 |

| Modern Investments | - | - | no standardized data |

| Passion Investments | 5% | 5% | Luxury Investment Index 2017 |

Summary

Everybody with money in the bank account or owning a property has an asset allocation. Probably, he is just not aware of it. So if you have an asset allocation anyway, why not manage it actively? The basic concept is to understand the 7 different asset classes and the risks associated with them.

- Cash & Cash Equivalents

- Bonds

- Equities

- Real Estate

- Commodities

- Passion Investments

- Modern Investments

Then you can make your personal choices and define in which asset classes you want to invest. Take the quiz below and continue reading our next article!