Having a Goal Is Important Before Investing

A dream becomes a goal when action is taken toward its achievement.

Bo Bennett, an entrepreneur who wrote “Year To Success” after selling his first company

Having a concrete aim that you are going for makes it much easier for you to visualize what you want. Thereby, you

- Are much more motivated to save money as you have a concrete reward that you are looking forward to

- You can measure your progress and see how you are getting closer

- You can structure each goal separately and take different risks according to the time horizon you are looking at for a concrete goal.

The Goal Is Different for Every Investor

All our dreams can come true, if we have the courage to pursue them.

Walt Disney, American entrepreneur and film producer, holds the record for most Academy Awards earned by an individual (22 Oscars from 59 nominations)

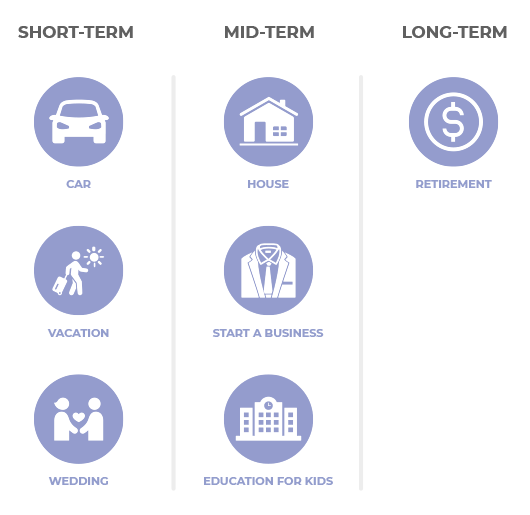

Investment goals are always oriented to the future. There are many goals to achieve, some of them might be very similar for many people. Others may be more specific, e.g. saving money for a Mustang or a special vacation.

Start with the most important aim that you are looking for, e.g. saving for a house, education of the kids or retirement.

- Save a down payment for a home

- Create a safety-net for retirement

- Save for your kid’s education

- Buy a car

- Take a special vacation

- Have a unique wedding

- Start a business

Depending on the time in which you want to achieve this aim, the goals can be classified into:

- Short-term goals (1-3 years)

- Mid-term goals (3-7 years)

- Long-term goals (more than 7 years)

Start Saving as Early as Possible!

Beware of little expenses; a small leak will sink a great ship.

Benjamin Franklin, one of the Founding Fathers of the United States, leading author, printer, political theorist, politician, freemason, postmaster, scientist, inventor, humorist, civic activist, statesman, and diplomat.

There is a certain level of saving that you should have created until now. Look at the table below to know the amount of money that you should have saved until now Fidelity Investments created an age-based savings guideline with savings goals.

When you retire at age 67, you should have eight times your annual pay to replace 85% of his or her pre-retirement income by savings. This means at age 35, you should have saved an amount equal to your annual salary, at 45, you should have saved three times your annual salary and at 55, you should have five times your salary.

Savings at a certain age (Fidelity Investments / New York Times)| Age | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 67 |

|---|

| Salary x | 0x | 0.5x | 1x | 2x | 3x | 4x | 5x | 6x | 8x |

|---|

Assumptions:

- Saving 6% at the age of 25 and increasing 1% a year to 12%

- 3% annual employer contribution

- No breaks in service or contributions; no loans or withdrawals

- Retirement age of 67

- 5.5% average annual hypothetical portfolio growth rate

- 1.5% annual salary increase

- Receives full social security

- Living to age 92

What we see here is that you must have a proper investment strategy to somehow close to the expectations. Current bank interest rates do not allow you to reach your objectives. Therefore, a profound investment strategy is indispensable. We will show you how to get there!