Sets Your Behavioral Rules

The four most dangerous words in investing: ‘this time it’s different.

Sir John Templeton, American-born British investor, in 1999, Money magazine named him "arguably the greatest global stock picker of the century."

The investment philosophy will save you from switching directions all the time and be influenced by just another article or tip from a friend that you should follow immediately. Without an investment philosophy, you will just follow one quick idea after the other – which will not lead to success. The investment philosophy must be determined before an investment strategy can be implemented.

An investment philosophy will save you from:

- Falling for short-term strategies that are being brought to you by people who only have their own benefit in mind – and most people in investment are like this!

- Changing the strategy every time you have a loss, resulting in higher transaction costs and higher taxes.

- Implementing a strategy that is not tailored for your objectives, risk aversion and experience in investing.

No Investment Philosophy or Strategy Is Perfect

There is nothing wrong with a ‘know-nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.

Warren Buffett, American investor, CEO of Berkshire Hathaway, considered one of the most successful investors in the world

The answer to this is quite easy! There is no perfect investment strategy. The first thing to understand for a winning strategy is that losses can always occur and that they should not change your investment philosophy and the general strategy – if you chose a consistent concept.

Only in sales pitches they are perfect. We are here to help you set-up this consistent concept. The investment philosophy is very individual to everyone, we will help you to determine yours.

However, there will always be a point in time where the market, your friends or yourself will question the philosophy. Then you should go back to the reasons why you created the strategy. And usually, you will find out that they are still valid. Give it some time! Your philosophy will be back on track! Also, with a consistent strategy of diversification, you will always find that one part secures the others, there should never be a time in your strategy where it all fails.

Let’s say stock prices go down, you will probably have some cash or cash equivalents or gold in your portfolio. Gold might be going up then, due to people fleeing into more secure asset classes. It is the perfect time to rebalance your portfolio and put some money from gold into the stocks. You will secure the low prices with the gains that you have made in goal. At this moment the right though is “my strategy is working” instead of “oh my god, I lost so much money in stocks”.

What Your Investment Philosophy Depends On

Your personal investment philosophy mainly depends on:

- the amount of time you want to invest and the

- level of skill that you are bringing to the table.

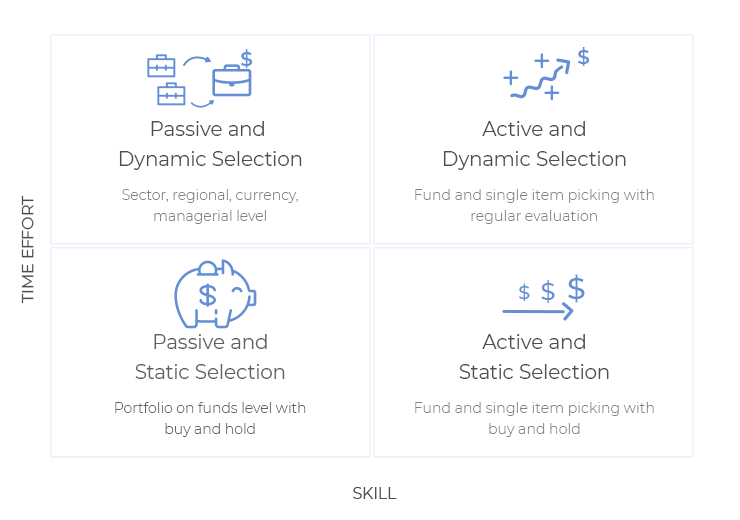

The more time you are willing to invest the more actively you can manage your portfolio, the more knowledge you have the more specific your investments can be. Therefore, we differentiate:

- active and passive investing for the amount of skill in terms of knowledge and experience that you have

- static and dynamic investing for the amount of time that you have.

The ’time effort’ describes the investor's willingness and the possibility to take care of his portfolio. If the investor has only a little time he can / wants to spend on his portfolio, he should choose a static approach, where long term picks are made and a buy and hold strategy is applied.

The more time the investor spends, the more dynamic the strategy can be and the constitution of the portfolio can be adjusted more often to current market trends.

The ‘skill’ describes the investor's experience and ability to understand markets and take conscious decisions. An investor with little skill should stick to a strategy that reflects the market development to reduce the risks. The selection is passive, there are no investments in single assets but only on asset class level.

The more experience an investor has, the more specific items can be part of the portfolio. Choosing actively single items for the portfolio, the investor should only buy these in the areas where his skills are at.

Conclusion

This leads to four basic types of Investments:

- The Passive and Static Selection (Portfolio on funds level with buy and hold)

- The Passive and Dynamic Selection (Portfolio on funds level with regular evaluation)

- Active and Static Selection (Fund and single item picking with buy and hold)

- Active and Dynamic Selection (Fund and single item picking with regular evaluation)

Passive and Static Selection

The Passive and Static Selection is the right strategy for investors with little or no experience and little time. The portfolio is based on funds to reduce the risks. Depending on the skill level, the investor only invests in asset class level or into specific funds that he has some knowledge about, e.g. specific sectors, regions, currencies or the management of a fund. The investor only checks to see if there are any major changes and to put in / take out money.

Passive and Dynamic Selection

The Passive and Dynamic Selection is the right strategy for investors with little or no experience and some time. The portfolio is based on funds to reduce the risks. Depending on the skill level, the investor only invests in asset class level or into specific funds that he has some knowledge about, e.g. specific sectors, regions, currencies or the management of a fund. The investor checks regularly to adjust the portfolio according to the latest developments in the market.

Active and Dynamic Selection

The Active and Dynamic Selection is the right strategy for investors with experience and some time. The portfolio is based on funds and single items. Depending on the skill level, the investor creates a diversified portfolio or a focused portfolio. The investor checks regularly to adjust the portfolio according to the latest developments in the market.

Active and Static Selection

Active and Static Selection is the right strategy for investors with experience and little time. The portfolio is based on funds and single items. Depending on the skill level, the investor creates a diversified portfolio or a focused portfolio. The investor only checks to see if there are any major changes and to put in / take out money.

Many People Want to Sell Their Investment Philosophy

The important thing about an investment philosophy is that you have one you can stick with .

David Booth, American businessman and the Executive Chairman of Dimensional Fund Advisors

There are millions of investment philosophies and each day there are coming new ones up. They are mainly there for marketing to cause a new hype and sell you just another product that makes the inventor (usually of the new name) rich. As mentioned previously, we use a very simple and clear distinction of the investment philosophy along with effort and skill.

To give you a small overview of terms that are used often, we will explain some. All of them can be classified into our scheme, they are not contradictive to the categories that we defined. However, they are usually bound to stocks. Our investment philosophy refers to investments in all different kinds of asset classes, e.g. stocks, funds, cash, commodities, etc. Regularly used investment philosophies for stocks are:

- Value investing: The investors seek stocks that are currently underpriced by the market and whose prices will eventually rise significantly (by investor’s opinion). It is based on the book “The Intelligent Investor” by Benjamin Graham, first published in 1949. He was the grandmaster of Warren Buffet, who later on achieved consistent returns of 20% annually on the stock market.

- Fundamentals investing: relies on identifying companies with strong earnings prospects.

- Growth investing: investors buy shares of companies whose products or services hold the potential to generate strong earnings growth and higher stock prices in the future.

- Technical investing: relies on the examination of past market data to uncover hallmark visual patterns in trading activity on which to base buy and sell decisions.

- Large cap investing: large capitalization (cap) stocks are companies with a market capitalization of $10 billion or more. Investing in them is popular among both growth and value investors as a portion of overall asset allocation. They stand for stability and steady dividend but offer little growth potential

- Small cap investing: small capitalization (cap) stocks are companies with a market capitalization of less than $10 billion. They have a huge growth potential plus most mutual funds don't invest in them. This means you can more easily find your niche and undervalued positions as they are often under-recognized. On the other hand, you must invest more time and take higher risks.

Summary

You should mainly define your Investment Philosophy based on the skill level you have and the time you are willing to spend. The more skill you have, the more specific you can use the knowledge and invest in specific items. The more time you have, the more actively you can buy and sell.