Different Asset Classes Have Different Risks

Take calculated risks. That is quite different from being rash

General George Patton, General of the United States Army, commanded troops of World War II in the Mediterranean and France and Germany following the Allied invasion of Normandy

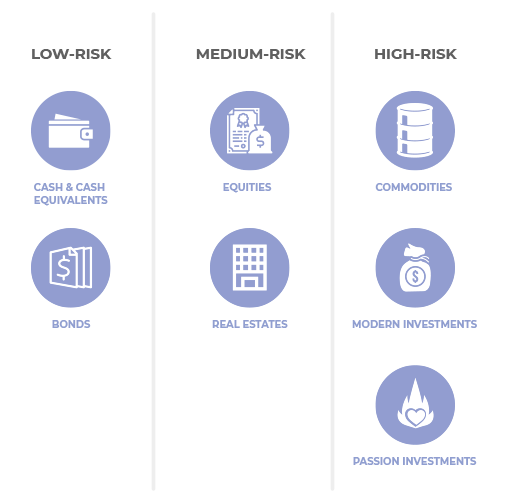

In investment there are different categories of investments, this is what is called assets or asset classes, e.g. cash, bonds or equities like shares in companies (stock). These are associated with different risks. Even though the risk of a specific investment in a category can be very different, many institutional and private investors classify the different categories with different risks.

This is not a general classification of risk, e.g. a bond from a country with a dictator can be very risky, meanwhile, bonds from the Federal Government of the United States are considered low risk. As a first introduction, see an overview below. A more detailed explanation comes later on in Part 3: The Implementation. More specifically, we will explain the instruments in article 3.1.

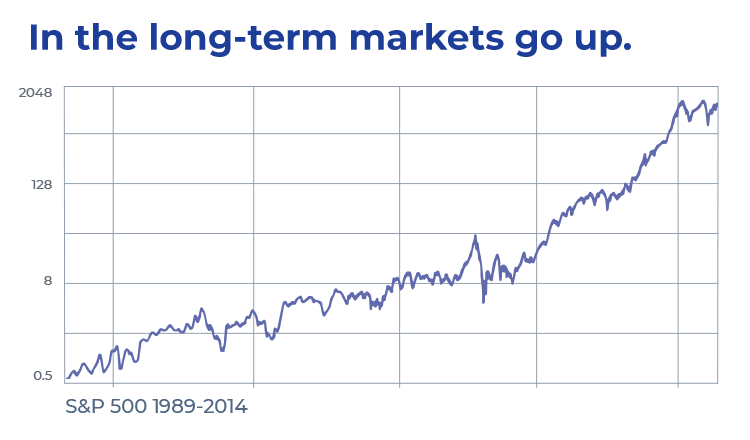

However, for you to choose the right asset classes, it is very important to understand how much risk you are willing to take. This also takes into account how much loss you can take and stay calm. There are always up and downs in investing but the trend in the long-term perspective is upwards in a well-balanced portfolio.

If a loss of 20% in one of your investments or in your portfolio lets you flip out, you should take lower-risk products. What is important to understand is, that the more risk you take the higher the chances for more profit are. Just to be said, there is no 0 risk strategy and a strategy with a low risk will result in lower returns.

As you can see in the following graph, the long-term trend of the S&P 500 is upwards, independent on when you invested! The stock market is extremely volatile. Other less volatile assets will also play an important role in your portfolio.

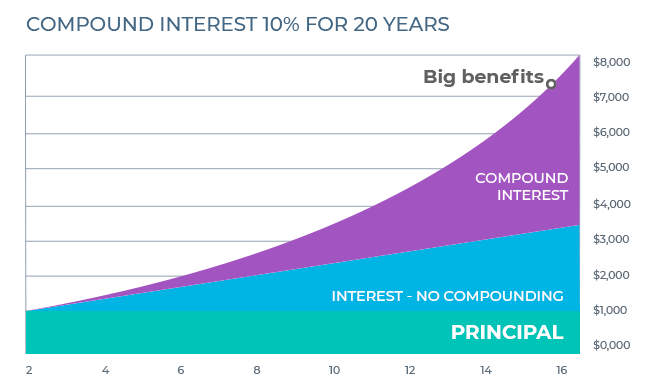

The Compound Interest Helps You

Also, when you invest in stocks, they will pay annual dividends. These dividends can be reinvested and increase your portfolio again. The following graph shows how reinvested dividends actually reflect in relation to the value of your portfolio.

If you take on more risk than you’re comfortable with, you may end up in emotion-based trading, which might lead to panic selling at lows and destroy your whole investment strategy.

Typically, investors who are willing to take higher investment risks are experienced and willing to take the chance to achieve higher returns. Risk and reward are interdependent and vary significantly by asset class and investment product.

The personal risk that you are willing to take is also depending on your age. When you are young you might be more willing to invest in higher-risk assets, also because there is more time left for the market to catch-up. When you are closer to retirement, you do not want to put that at risk.

Every Investment Has a Risk - Even Cash

Progress always involves risks. You can’t steal second base and keep your foot on first.

Frederick B. Wilcox, American Investor, in Unicorns and Tadpoles, 1958

There is no such investment without risk. Even cash in bills or on the bank is associated with a certain risk. So whatever you do with your money, there is a risk to lose (a share of) it. This can have different reasons, below you find some of them:

Inflation Risk

Inflation risk is especially affecting investors who hold a lot of cash or cash equivalents. Over time the money loses value due to inflation, if your interest rate is lower than the inflation, you are effectively losing money. The same issue occurs with investments that have a fixed rate of return which falls behind the rate of inflation.

Liquidity Risk

Liquidity risk occurs in restricted or little traded markets. You may own an investment and you cannot sell it immediately. At that moment you own something of a certain value but it is illiquid as you cannot sell it immediately to get cash in return.

Volatility Risk

Volatility risk is predominant in specific industries and in commodities. Political events or regular market fluctuations may affect prices. Prices are volatile, this means they go up and down a lot.

Business Risk

Business risk accounts mainly for stocks and bonds. A company might lose its business and go into bankruptcy, this is where stocks and bonds lose all of their value. The assets of the company will be liquidated and distributed according to a scheme that is defined by law. Bondholders are paid first, followed by preferred stockholders and finally common stockholders. Usually, investors do not get all of their money back!

Currency Risk

Currency risk accounts for international investments. If the foreign money depreciates more than the gains you made in the investment, you have lost money. On the other hand, you might boost your investment when the currency is picking up!

Market Risk

Market risk describes the general downturn of a market, e.g. due to political reasons or economic reasons (the burst of a bubble). It is not tied to a market sector or the performance of a particular company. Therefore, it is systematic. You cannot eliminate the market risk through diversification, though you can hedge against it through investing in asset classes that behave contrarily to the one that you want to hedge.

Every Investor Has to Define His Risk Profile

If you risk nothing, then you risk everything.

Geena Davis, American actress, Oscar and Golden-Globe winner

Every investor is unique due to different needs and goals, meaning there is no right or wrong amount of risk you should take. The risk tolerance scale ranges from conservative at the low end, moderate in the middle and aggressive at the high end.

There are many questions and tests out there do determine your willingness to take a risk. But let’s make it very simple with the following possible investment possibilities:

In which stock would you prefer to invest?

- a stock that could have gains of 20% but losses of 5% on a regular basis (conservative = high risk aversion, low risk seeking) or

- a stock that could have gains of 70% but losses of 20% on a regular basis (moderate = moderate risk aversion, moderately risk seeking) or

- a stock that could have gains of 200% but also losses of 100% on a regular basis (aggressive = Low risk aversion, risk seeking)?

Determining the level of risk and reward needed is a key aspect of determining an investment strategy.

Investments Should Be Based on the Following Decisions

Take risks: if you win, you will be happy; if you lose, you will be wise.

unknown author

There are higher and lower risks associated with the asset classes. For sure, even within one asset class the risks can be distributed very differently. Penny stocks have a much higher risk than large-cap stocks, also the penny stocks have a higher potential upside.

The same accounts for cash, investments in other currencies have a much higher risk than investments in your currency.

However, following the previously made distinction in different asset classes, risks can be associated as follows:

- Low-Risk Investments: Cash & Cash Equivalents, Bonds

- Medium Risk Investments: Equities, Real Estate

- High-Risk Investments: Commodities, Modern Investments (Alternative Investments), Passion Investments (Alternative Investments)

After all, you can create your personalized portfolio, which could look like this:

- Conservative: invests 50-70% in low-risk investments and the rest in medium-risk investments. Reduces the risk of loss but therefore accepts a lower return in the long term.

- Balanced: invests 50-70% in medium-risk investments and the rest in low-risk investments. This strategy aims for reasonable returns, with the increased possibility of returns compared to the conservative portfolio and reduced risk of losses in bad years compared to the growth portfolio.

- Growth: invests 70-90% in medium-risk investments, e.g. stocks and 30% in low risk aims for higher average returns over the long term.

Remark: This is for example purpose only and is not some investment advice!

There are also two sorts of extremes:

- Cash: invests 100% in low-risk investments. This strategy is only suitable for short-term investments or as an intermediate solution to parking the money in a safe harbor. It is not an actual investment strategy. It might be suitable if you are in retirement already and have enough money saved and do not want to risk anything:

- Exponential growth: invests 10-20% in high-risk investments, 80-90% in medium-risk investments. If you want to go high risk and you are willing to risk even a complete loss. Only for very risk-taking young people who know what they are going for.

Based on your individual preferences, you can create a personalized risk portfolio in our Investment Canvas.

Summary

Every investment is associated with risk. The average risk depends on the asset classes, however, risks can hugely vary within one asset class. You should define your own willingness to take risks to define your Investment Canvas.