Which Different Kinds of Bonds Are There?

Bonds can be differentiated by the issuers. A government as well as municipalities and private or public companies can issue bonds. The following table gives an example of different kinds of bonds. Bonds are an established instrument all over the world so that you can also buy bonds from foreign governments or companies. To classify the quality of a bond, there are ratings among other features, which will be explained in the following.

Different Kinds of Bonds

Corporate Bonds

Government bonds are issued by a government to pay for government activities and pay off government debt. In the US bonds are differentiated into three categories, other government just offer bonds with different maturities that are named the same:

- T-Bonds: Treasury bonds or T-Bonds have maturities from 10 up to 30 years and therefore are considered long-term investments.

- T-Notes: Treasury Notes or T-Notes have a fixed interest rate and a maturity between one and 10 years

- T-Bills: Treasury bills or T-Bills are short-term investments with a maturity of some days up to one year. T-Bills do not receive a regular interest; instead the interest is reflected in the amount it pays when it matures. The longer the maturity the higher the interest paid. They are seen as cash equivalents.

Other bonds, e.g. Government-Sponsored Enterprises (GSE) bonds

There are other options for bonds. E.g. the US government agencies, so-called Government-Sponsored Enterprises (GSE) issue bonds to finance public projects, e.g. support for small companies, home buyers or students. Examples are Fannie Mae and Freddie Mac. These bonds are not backed by the US government.

Municipal bonds

Municipal bonds are issued by a state, city or local government to finance local development.

What Are the Features of Bonds?

A bond has different features. The nominal amount is the amount on which the issuer pays interest and that usually has to be repaid at the maturity date. The maturity is the date at which the issuer has to repay the nominal amount. The coupon is the interest rate that the issuer pays to the holder. The market price is the price that is paid on the secondary market for a bond that was already issued. The yield is the rate of return received from investing in the bond. The credit quality is the Probability that bondholders will receive the interest rate regularly and nominal at the maturity date.

Terms and Definitions

Nominal amount (also: principal, par, or face amount)

The amount on which the issuer pays interest and that usually has to be repaid at the maturity date. There are some exceptions where the amount is depending on the performance of an asset.

Maturity

The date at which the issuer has to repay the nominal amount. Each bond has assigned a fixed date at which the nominal will be paid back.

Term (also: tenure or maturity of a bond)

The length of time until the maturity date. The term can be any length of time, most bonds have a term of fewer than 30 years. Bonds with a term of less than one year are usually designated money market instruments rather than bonds. Depending on the term, the following distinctions are made:

- short-term (bills): maturities between one and five years

- medium-term (notes): maturities between six and twelve years

- long-term (bonds): maturities longer than twelve years.

Coupon

The interest rate that the issuer pays to the holder. Usually fixed rates but can also vary with a money market index.

Market Price

The price that is paid on the secondary market for a bond that was already issued. Bonds can be traded on the secondary market just like stocks. The bond price can sell at a premium or at a discount. When market interest rates have fallen since the issue of the bond, they usually trade above par, as the older bonds give a higher yield. The market prices may be influenced by:

- current interest rates

- currency

- time of interest payments

- quality of bond

Prices can be calculated differently:

- Dirty: includes the present value of all future cash flows and accrued interest (mostly used in Europe)

- Clean: not including accrued interest (mostly used in the U.S)

Yield

The rate of return received from investing in the bond.

- current yield (also: running yield): annual interest payment divided by the current market price of the bond (clean price).

- The yield to maturity, or redemption yield: takes into account the current market price, and the amount and timing of all remaining coupon payments and of the repayment due on maturity. It is a more useful measure of the return of the bond.

Credit quality

The probability that bondholders will receive the interest rate regularly and nominal at the maturity date. Credit rating agencies are companies that assign credit ratings. Thereby they rate the debtor's ability to pay back the debt. Even though they sound promising as they give higher yields, high-yield bonds are bonds that are rated below investment grade by the credit rating agencies. This means a higher risk of default is associated with them. They are also called junk bonds.

What Are the Advantages of Bonds?

Bonds generally are safer investments compared to securities like stocks and they pay a fixed interest rate. This allows to receive interest rates with little active management necessary. Also there are tax advantages for some bonds. In the following, the advantages will be explained more detailed:

- Safer than other instruments: Compared to other investments bonds are rather safe. Their quality can be assessed by their rating. At certain market conditions, when investors flee from stocks into safer assets like bonds, bonds profit from the so-called “safe-haven buying” where the price of the bond increases. Even though the risk is very small, bonds still have a risk.

- Interest rate: Bonds pay a much higher rate of interest compared to other safer forms of investments (e.g. saving accounts in banks).

- No active monitoring/management necessary: bonds do not need constant monitoring and management like some other investment instruments. Anticipation is not necessary when the investor follows a long-term strategy. Interest payments arrive regularly and the nominal is paid back on the maturity date.

- Tax advantages: Especially Municipal bonds can be exempt from income tax. This increases its actual yield.

What Are the Disadvantages of Bonds?

The major disadvantage of a bond is the relatively low interest rate compared to more risky instruments. The disadvantages will be summarized in the following:

- Lower return on average: compared to other instruments, e.g. stocks, the rate of interest is less. Therefore, especially younger people who can take more risks use other instruments.

- Credit risk: Especially corporate bonds carry the risk that the company is going bankrupt and the nominal will not be paid back. However, this has also already happened to governmental bonds.

- Long-term commitment: Bonds can have a wide range of maturity terms. Depending on the term you chose your money is bound. However, you can always consider to sell it on the secondary market.

- Rising interest rates: Rising interest rates will make the market price of your bond go down. Also, you would have achieved a higher return if you invested later. This is not related to the underlying fundamentals and credit quality but to market conditions.

How Does the Bond Rating Work?

Bonds are considered a lower-risk investment than stocks but they are not risk-free. The easiest way to assess the quality of a bond is the rating. Even though the ratings might object to fraud, when rating agencies do not do their job well as we saw in the 2008 crisis, the ratings give a first overview. Especially when looking at ratings of single securities instead of bond funds, ratings give a first glance. The three major bond rating agencies are Standard & Poor's, Moody's, and Fitch. A combination of letters, numbers, and symbols indicate the quality of the bond.

| Moody's | S&P | Fitch | Grade | Risk |

|---|

| Aaa | AAA | AAA | Investment | Lowest Risk |

| Aa1 | AA+ | AA+ | Investment | Lowest Risk |

| Aa2 | AA | AA | Investment | Lowest Risk |

| Aa3 | AA- | AA- | Investment | Lowest Risk |

| A1 | A+ | A+ | Investment | Lowest Risk |

| A2 | A | A | Investment | Lowest Risk |

| A3 | A- | A- | Investment | Lowest Risk |

| Baa1 | BBB+ | BBB+ | Investment | Medium Risk |

| Baa2 | BBB | BBB | Investment | Medium Risk |

| Baa3 | BBB- | BBB- | Investment | Medium Risk |

| Ba1 | BB+ | BB+ | Junk | High Risk |

| Ba2 | BB | BB | Junk | High Risk |

| Ba3 | BB- | BB- | Junk | High Risk |

| B1 | B+ | B+ | Junk | High Risk |

| B2 | B | B | Junk | High Risk |

| B3 | B- | B- | Junk | High Risk |

| Caa | CCC | CCC | Junk | High Risk |

| Ca | CC | CC | Junk | High Risk |

| C | C | Junk | Highest Risk |

| C | D | D | Junk | In Default |

A bond is considered investment grade (IG) when the credit rating is BBB- or higher by Standard & Poor's or Baa3 or higher by Moody's. Only if a bond achieves IG, banks are allowed to invest in them. The higher a bond’s rating is, the safer the investment is. However, higher-rated bonds also have lower interest rates usually.

Bonds below IG offer high yields but have a high potential to default. This is why they are called high-yield or junk bonds. The rating can give a view on the current situation. However, circumstances can change and along with them the ratings. Therefore the direction a bond has been taking compared to previous ratings is an additional source of information.

Which Bonds Should I Buy?

To further reduce the remaining risk, the bond investments should be diversified. The easiest ways to diversify are bond mutual funds or exchange-traded funds (ETF). Like other mutual funds or ETFs, they specialize in a particular type of bond, e.g. with a specific maturity or credit rating. Also, the entry point is lower for a fund or ETF than for the original bond. As with other instruments, costs should be kept as low as possible. Also, the investor should understand the product that he invests in.

However, in certain cases bonds make sense for the single investor as he can control maturity and interest rates among the risk that he is willing to take by himself. The safer the bond chosen is, the more an individual bond is an option. High-yield bonds should only be bought, when the investor is willing to risk all of the money invested. Municipal bonds offer tax advantages and can, therefore, be a good investment.

How many bonds are there to choose from?

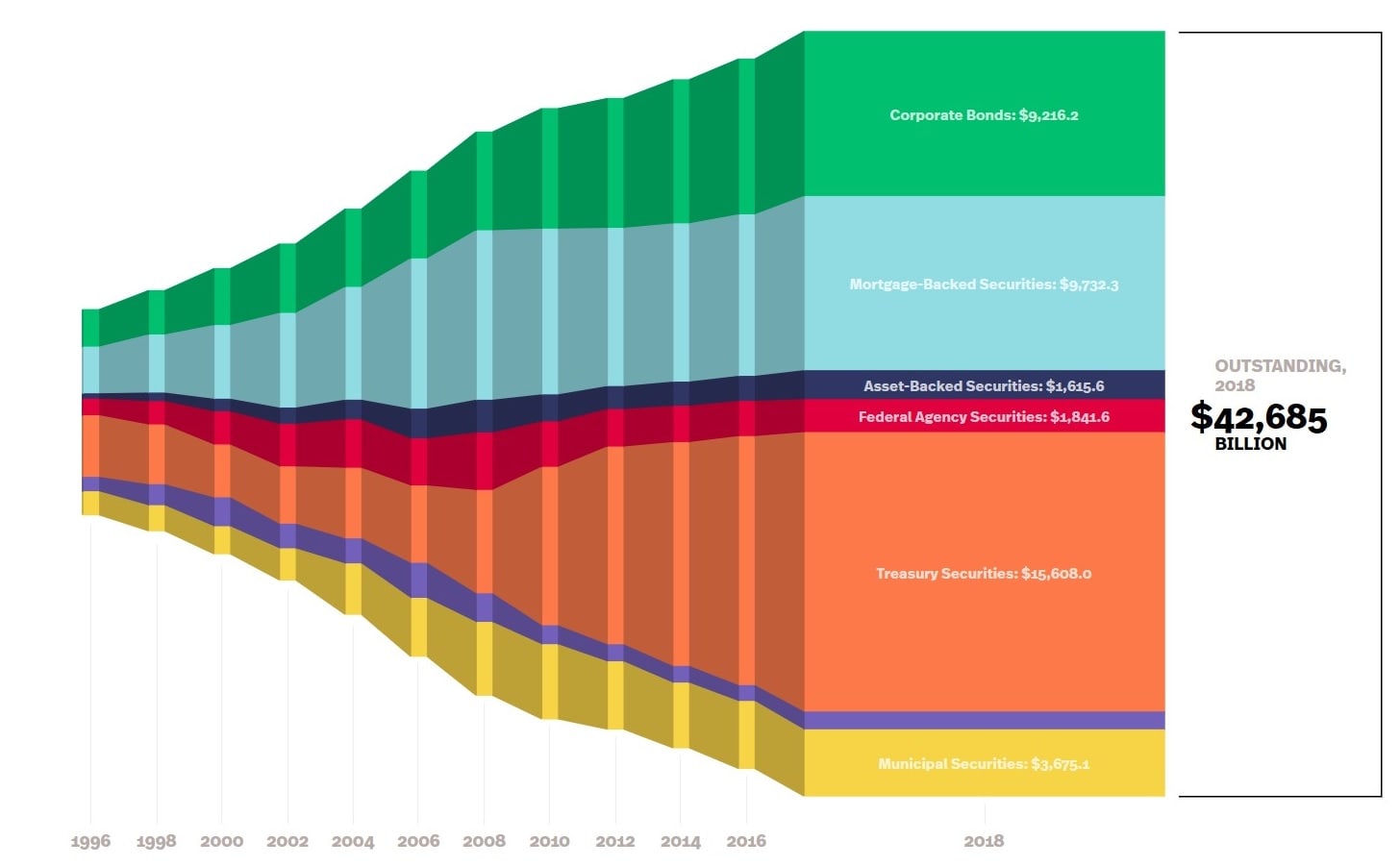

Currently there are 1.1 million bonds currently available or sold over public exchanges according to Fidelity Investments. The total bond market in the US was $ 42,658 billion in 2018.

Which Costs Are Associated With Bonds? Do I Have to Pay Taxes on Bonds?

The best possibility to buy bonds is directly through the issuer, e.g. the US government. However, you will not have access to all issuers directly and also not to the secondary market. Therefore, you can purchase bonds also through brokers. When you buy bonds through brokers, there are no direct fees as you can see them when buying stocks. The so-called mark-ups are included in the price of the bond. However, since May 2018 brokers must clarify the mark-up, but only after a transaction.

Many investors do not know their exact costs when buying bonds. As mark-ups reduce a bond’s yield, they reduce the investors' return. Therefore, the investor should well consider beforehand which broker to choose. Also, when buying bonds you should consider tax effects. Some bonds are exempt from state and local taxes. Most municipal bonds are exempt from federal, state and local taxes. The following table gives an overview of the different bond types and taxation in the US as an example.

Do I Have to Pay Taxes on Bonds?

| Bond Type | Description |

|---|

| Corporate Bonds | Corporate Bonds are fully taxable. Therefore, they usually pay a higher interest rate than government bonds. |

| Government Treasury Bonds & Government Treasury bills (T-bills) | Government bonds are exempt from state and local taxes. |

| Other bonds, e.g. Government-Sponsored Enterprises (GSE) bonds | Most GSE bonds are exempt from state and local taxes. |

| Municipal bonds | Most municipal bonds are exempt from federal, state and local taxes. |

Where Can I Buy or Trade Bonds?

The stock market is well known and a market place where stocks are traded. Prices are established by demand. However, there are also market places for bonds. The market is called secondary because the transaction takes place after the initial release. A stock has an Initial purchase order (IPO) date and a bond as well is released on a specific date on the primary market and can then be traded on the secondary market.

The possibility to trade bonds on the secondary market increases its liquidity. Bonds, as well as stocks, are securities. However, when you have a stock you own a part of the company, when you own a bond you are a creditor. This means as a stock owner you receive dividends as a share of the profit, as a creditor you receive a fixed fee. The advantage is, that as a bond owner you have priority in case of bankruptcy compared to the stock owner.

Only a few of the 1.1 million bonds (Source: Fidelity Investments) are traded publically. Bonds are not traded publically like stocks on a public exchange but over the counter. This means you necessarily need a broker to buy them on the secondary market. The main problem here is that it is difficult to judge if you get a fair price, independent of whether you are selling or buying. The broker can add a premium to the price. The Financial Industry Regulatory Authority (FINRA) regulates the bond market by publishing transaction prices. However, there can be a lag in the information. This is an important background to know but not a reason not to buy bonds. There is an important difference for treasury bonds, which you can buy directly from the U.S. government.

How Can I Invest in Bonds?

For novice investors there are following options:

- Bond ETFs (Exchange Traded Funds) have low transaction costs and are well suitable if you want to invest in bonds.

For investors with investment experience in private context there are some more alternatives:

- Bond Funds are funds that invest in bonds, which have a due date of more than 30 days.

Investors with investment experience in a professional context can also invest in:

- Single Bonds, but as there are many different sorts of bonds, we suggest to buy established bonds of companies and governments, if you are not an expert.

- Bond options are a derivative that gives the buyer the right (but not the obligation) to buy the bond at a later point of time at a previously defined price. For further information look up options.

- Bond futures are futures that use bonds as an asset. For further information look up futures.

- Bond CFDs are CFDs that contain Bonds in the contract. For further information look up CFDs.

For Full-time professional Investors there are some more instruments out there:

- Bond Swaps are Swaps where bonds are exchanged. For further information look up swaps.

- Bond Hedge Funds are hedge funds that invest in bonds. For further information look up hedge funds.

To actually purchase bonds you can use:

- Online Brokers, to trade stocks, ETFs, bonds, futures and FOREX, bonds. See our Guide: How to find your online broker

- Websites of the respective governments or companies, e.g. Treasury direct, where you can buy US bonds directly from the government with no fee!